Net site area: The gross site area, less any deductions.Deductions: A portion of the gross site area that cannot be built on, such as public access areas, roads, lanes, etc.Gross site area: The two-dimensional measures of a site, based on its property lines.Gross leasable area (GLA): The sum of all enclosed livable space.Gross building area (GBA): The sum of all building spaces from wall to wall.Floor space ratio (FSR): Used to determine the size of a building and control the density of development on a parcel of land.

The long-term value will be much lower than that of an income-producing property.

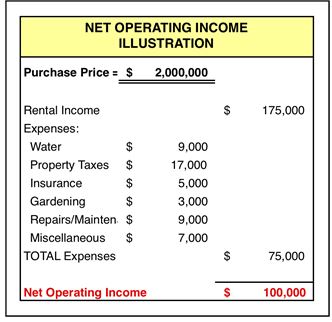

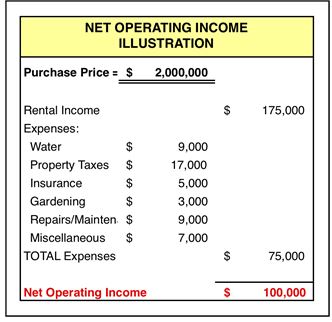

Land loan: Financing used to acquire a piece of land with no NOI. Limited partner (LP): A passive investor who has limited ability, based on the amount they have invested in the project. General partner (GP): An owner of a partnership with unlimited liability – usually a manager who actively participates in the operations. Term: The length of time that the interest rate on a mortgage loan is agreed for. Amortization period: The number of periods (months or years) the principal repayments of a loan take to be completed. Cap rate: NOI divided by the value of the property, expressed as a percentage. Net operating income (NOI): Gross rental revenue less operating expenses (property taxes, insurance, maintenance, etc.). Loan to cost (LTC): The amount of debt financing a lender will provide as a percentage of the cost of a development. Loan to value (LTV): The amount of debt financing a lender will provide as a percentage of the market value of the real estate. To build a financial model, we need to understand the important terms and definitions frequently used in real estate project finance: Real Estate Project Finance Industry Terms and Definitions Senior debt is the most secured capital, while equity is the riskiest out of the three. The capital stack, which consists of all of the different types of financing that may be used, typically comprises the following: Trade-offs between fixed and floating interest rate. Term that matches the length of time it takes to develop and sell the project. Security and priority for various lenders in the capital stack. Draws on construction loans for financing. When it comes to funding real estate project finance, the capital stack includes several considerations, as follows: Capital Stack in Real Estate Project Finance In real estate project finance, equity used to fund the project is usually repaid at the end of a specific time horizon. The corporation might also issue equity with an indefinite time horizon. It can also use its general creditworthiness to borrow money and fund the project. When a corporation takes on a new investment, it can use cash flows from other operating activities to fund the new project. Real Estate Project Finance vs Corporate Finance Typically, the financing is made up of debt and equity matched to the lifespan of the asset. Real estate project finance cash flows should be sufficient to cover operating expenses and to fund the financing repayment requirements. Other examples of project finance include mining, oil and gas, and buildings and constructions. Real estate project finance is a classic example.

Project finance is long-term financing of an independent capital investment, which are projects with cash flows and assets that can be distinctly identified. Updated MaWhat is Real Estate Project Finance?

0 kommentar(er)

0 kommentar(er)